DEPOSIT RATES

Rates are subject to change at any time.

Balance | Dividend Rate | BONUS Dividend Rate* | Annual Percentage Yield (APY) | BONUS Annual Percentage Yield (APY)* | Minimum Opening Deposit | Minimum Balance to Earn APY | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0 - $9,999.99 | 0.88% | 1.75% | 0.88% | 1.76% | $25.00 | $0.01 | Monthly |

$10,000 - $24,999.99 | 1.13% | 2.25% | 1.13% | 2.27% | $25.00 | $10,000 | Monthly |

$25,000 - $49,999.99 | 1.38% | 2.75% | 1.38% | 2.79% | $25.00 | $25,000 | Monthly |

$50,000 - $99,999.99 | 1.63% | 3.25% | 1.64% | 3.30% | $25.00 | $50,000 | Monthly |

$100,000 - $249,999.99 | 1.75% | 3.50% | 1.76% | 3.56% | $25.00 | $100,000 | Monthly |

$250,000+ | 1.88% | 3.75% | 1.89% | 3.82% | $25.00 | $250,000 | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.10% | 0.10% | $5.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.10% | 0.10% | $0.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.10% | 0.10% | $5.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.10% | 0.10% | $5.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.10% | 0.10% | $0.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

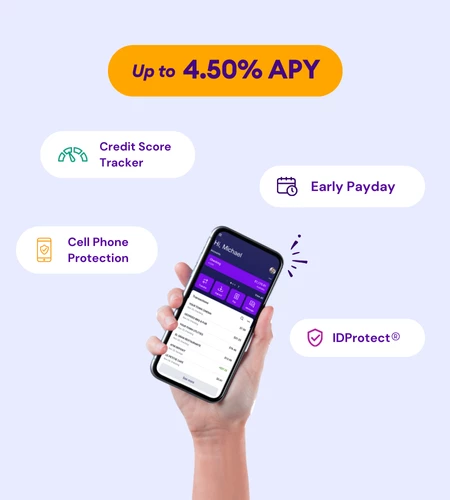

$0.00-$50,000.00 | 4.40% | 4.50% | $100.00 | $0.01 | No Service Fees | Daily | Monthly |

$50,000.01 and up | 0.03% | 0.03% | $100.00 | $50,000.01 | No Service Fees | Daily | Monthly |

$0.00-$50,000.00 (High Yield Requirements Not Met)* | 0.03% | 0.03% | $100.00 | $0.01 | No Service Fees | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.03% | 0.03% | $10.00 | $0.01 | $0.00 | Daily | Monthly |

Balance | Dividend Rate | Annual Percentage Yield (APY) | Minimum Opening Deposit | Minimum Balance to Earn APY | Minimum Balance to Avoid Service Fee | Dividends Compounded | Dividend Credited |

|---|---|---|---|---|---|---|---|

$0.01+ | 0.03% | 0.03% | $10.00 | $0.01 | $0.00 | Daily | Monthly |

Term | Dividend Rate | BUMP Dividend Rate* | Annual Percentage Yield (APY) | BUMP Annual Percentage Yield (APY)* | Minimum Opening Deposit | Early Withdrawal Penalty | Dividends Compounded Credited |

|---|---|---|---|---|---|---|---|

6 months | 3.63% | - | 3.70% | - | $1,000 | 90 Days Dividends | Monthly |

7 months | 4.16% | - | 4.25% | - | $1,000 | 90 Days Dividends | Monthly |

12 months - Bump Up* | 3.68% | 3.92% | 3.75% | 4.00% | $1,000 | 90 Days Dividends | Monthly |

18 months | 3.92% | - | 4.00% | - | $1,000 | 180 Days Dividends | Monthly |

24 months | 3.92% | - | 4.00% | - | $1,000 | 180 Days Dividends | Monthly |

36 months | 3.92% | - | 4.00% | - | $1,000 | 270 Days Dividends | Monthly |

48 months - Bump Up* | 3.68% | 3.92% | 3.75% | 4.00% | $1,000 | 365 Days Dividends | Monthly |

Term | Dividend Rate | BUMP Dividend Rate* | Annual Percentage Yield (APY) | BUMP Annual Percentage Yield (APY)* | Minimum Opening Deposit | Early Withdrawal Penalty | Dividends Compounded Credited |

|---|---|---|---|---|---|---|---|

6 months | 3.63% | - | 3.70% | - | $1,000 | 90 Days Dividends | Monthly |

7 months | 4.16% | - | 4.25% | - | $1,000 | 90 Days Dividends | Monthly |

12 months - Bump Up* | 3.68% | 3.92% | 3.75% | 4.00% | $1,000 | 90 Days Dividends | Monthly |

18 months | 3.92% | - | 4.00% | - | $1,000 | 180 Days Dividends | Monthly |

24 months | 3.92% | - | 4.00% | - | $1,000 | 180 Days Dividends | Monthly |

36 months | 3.92% | - | 4.00% | - | $1,000 | 270 Days Dividends | Monthly |

48 months - Bump Up* | 3.68% | 3.92% | 3.75% | 4.00% | $1,000 | 365 Days Dividends | Monthly |

Disclosures

Except as specifically described, the following disclosures apply to all accounts.

All accounts described in this Deposit Rate document are share, share draft, share certificate, and share IRA accounts.

WELLBY ACCOUNTS — To open an account with Wellby, you must deposit or already have on deposit the minimum required share(s) in a Share Savings account. Primary Savings, Wellby Early Start Savings, and Wellby Achievement Savings Accounts. As a condition of membership, you must purchase and maintain the minimum required share(s) as set forth below, which will be funded by Wellby.

Par Value of One Share: $5.00

Number of Shares Required: 1

NCUA SHARE INSURANCE FUND: Funds are federally insured to at least $250,000.00 by the National Credit Union Administration (NCUA), a United States Government Agency, and backed by the full faith of the United States of America Government.

NATURE OF DIVIDENDS — Dividends are paid from current income and available earnings after required transfers to reserves at the end of the dividend period.

RATE INFORMATION. The Annual Percentage Yield (APY) is a percentage rate that reflects the total amount of dividends to be paid on an account based on the dividend rate and frequency of compounding for an annual period. For Primary Savings, Wellby Savings, Wellby Early Start Savings, Wellby Achievement Savings, Wellby Savings Plus, Wellby Traditional IRA Savings, Wellby Roth IRA Savings, Wellby Educational IRA Savings, Wellby Spending Checking, Wellby Secure Spending Checking, Wellby Spending Plus Checking, Wellby Early Start Card, Wellby Achievement Card, and dividend rates and annual percentage yields are variable-rates The variable-rate may change without notice. Wellby Certificate and IRA Traditional, Roth, and Educational Share Certificates are fixed-rate accounts during their term until maturity.

ACCRUAL OF DIVIDENDS. For all dividend earning accounts, interest will begin to accrue on the business day that non-cash items (i.e., checks) are deposited to the account. If you close your account before interest is paid, you will not receive the accrued interest.

COMPOUNDING AND CREDITING. The compounding and crediting frequency of dividends and the dividend period applicable to each account are stated in the Rate Schedule. The dividend period is the period of time at the end of which an account earns dividend credit. The dividend period begins on the first calendar day of the period and ends on the last calendar day of the period.

DEPOSIT AND MINIMUM BALANCE REQUIREMENTS. The minimum opening deposit for a share savings account is the required par value as disclosed in the fee schedule. The minimum balance requirements may include, the minimum balance you must maintain in the account to avoid service fees, and the minimum balance that you must maintain each day to earn the stated Annual Percentage Yield (APY) for that account.

BALANCE COMPUTATION METHOD. We use the Daily Balance to calculate interest on your account. The Daily Balance Method applies a daily periodic rate to the full amount of principle in the account each day. Dividend (interest) calculation method: Dividends accrue from the day the deposit is posted, up to the day of withdrawal. The daily rate is applied to the end of day balance in the account. The daily rate is 1/365 of the dividend (interest) rate, or in a leap year, we may use 1/366 of the interest rate.

ACCOUNT AND TRANSACTION LIMITATIONS. This account has transaction limitations as listed above: After the account is opened, you may not make additions to the account until the maturity date stated on the account. If you withdraw funds after the account is opened, partial withdrawals are not permitted. All funds must be withdrawn as part of an early withdrawal, and you may be charged a fee as disclosed in the Early Withdrawal Penalties.

MATURITY. Your account will mature according to the term indicated above, and as indicated on your account summary or statement.

EARLY WITHDRAWAL PENALTIES. A penalty may be imposed for withdrawals before maturity. If an early withdrawal penalty is imposed, the penalty may be imposed regardless of whether dividends that equal the amount of the penalty have been earned at the time of withdrawal. To the extent that dividends in the Certificate account at the time of withdrawal are insufficient to pay the entire penalty assessed, the penalty will be assessed against the principal. If you close your Wellby Primary Savings account before dividends are credited, you will also be required to close your Share Certificate accounts with us, and you will receive any accrued dividends on any of the closed accounts.

Withdrawal of Dividends Prior to Maturity: The annual percentage yield assumes that dividends will remain in the account until maturity. A withdrawal of dividends prior to maturity will reduce earnings and lower the annual percentage yield. Time Requirements: Your account will mature as specified on your Certificate or renewal notice. In certain circumstances, such as the death or incompetence of an owner of this account, the law permits, or in some cases requires the waiver of the early withdrawal penalty. Other exceptions may also apply, for example, if this is part of an IRA or other tax-deferred savings plan. For IRA Certificates additional IRS restrictions and rules apply. More information is available upon request.

RENEWAL POLICY. This account will automatically renew at maturity. You may prevent renewal if you notify us by telephone or by written notice before maturity, or before the end of the five (5) day grace period of your intention not to renew. You will have a grace period of five (5) calendar days after maturity to withdraw the funds without being charged an early withdrawal penalty. If you prevent renewal, dividends will not accrue after final maturity. You will receive a maturity notice at least 20 days prior to the maturity date. The dividend rate and APY that will apply to your account if the Certificate is renewed may not be determined as of the date of this notice. At maturity, you may call the credit union at (281) 488-7070 or (800) 940-0708 to determine the dividend rate and APY that will apply to your account if it is renewed.

We reserve the right to decline a Certificate renewal. Each renewal term will be the same as the original term beginning on the maturity date unless that term was promotional or is no longer offered. If the term was promotional or is no longer offered, the new term will be disclosed on the maturity notice you receive 20 days prior to maturity. The renewal term will begin on the maturity date of the Certificate.

The dividend rate will be the same as we offer on new Share Certificate accounts as of the maturity date, which has the same term, minimum balance requirements (if any), and other features as the original Share Certificate account.

SECURITY FOR LOANS. IRA-Favored Certificates cannot be pledged as security for a loan.

PRIMARY SAVINGS. The Primary Savings account requires $5.00 to open and has no minimum balance requirements.

WELLBY SAVINGS. The Wellby Savings account requires $0.00 to open and has no minimum balance requirements. If the account remains with a zero ($0.00) balance and has not been funded with a deposit within the first 60 days of opening, we may close the account due to your inactivity.

WELLBY SAVINGS PLUS. The Wellby Savings Plus account is a tiered rate Money Market share account. The minimum opening deposit balance is $25.00. The minimum balance to obtain the stated APY for each tier is listed in the account matrix above. **Account features include a bonus rate whereby you may achieve an APY that is double the standard APY listed. To qualify for the bonus rate, you must have an active checking account and receive at least $300.00 in aggregate direct deposits per month; registering for and accessing online banking at least once every three (3) months, and one of the following: eight (8) or more posted debit card transactions or posted debit card payments of a bill from your Wellby checking account per month; eight (8) or more posted credit card transactions from your Wellby credit card account per month; or $40,000.00 or more in lending balances (does not include credit cards).

WELLBY TRADITIONAL, WELLBY ROTH, AND WELLBY EDUCATIONAL IRA SAVINGS. The Wellby Traditional, Wellby Roth, and Wellby Educational IRA Savings accounts require $0.00 to open and have no minimum balance requirements. If the account remains with a zero ($0.00) balance and it has not been funded with a deposit within the first 60 days of opening, we may close the account due to your inactivity. The dividend period is monthly; for example, the beginning date of the first dividend period of the calendar year is January 1, and the ending date of such dividend period is January 31.

All other dividend periods follow this same pattern of dates. The dividend declaration date is the last day of the dividend period, and for the example above, it is January 31. If you close your account before dividends are paid, you will receive the accrued dividends. Individual Retirement Accounts (IRAs) may have additional IRS restrictions and rules that apply to this account. Please consult your account agreement or tax advisor for additional information.

WELLBY EARLY START SAVINGS. Must be 4 to 12 years of age. A parent or legal guardian (18 years or older) must open the account and authorize the collection, use, and disclosure of the child's information. Please refer to the COPPA Privacy and Direct Notice to Parents disclosures to understand and exercise your rights for this account. Some features may not be available from certain vendors if they don't allow anyone under the age of 13 due to the Children's Online Privacy Protection Act (COPPA). The Early Start Savings account requires $5.00 to open and has no minimum balance requirements. At age 13, this account will convert to a Wellby Achievement Savings account. The dividend rate and annual percentage yield listed for

this account in the Rate Schedule will apply if your balance is $0.01 or above.

WELLBY ACHIEVEMENT SAVINGS. Must be 13 to 17 years of age. A parent or legal guardian (18 years or older) is required to sign as a joint owner on the account. The Achievement Savings account requires $5.00 to open and has no minimum balance requirements. At age 18, the account will convert to a Primary Savings account. The dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply if your balance is $0.01 or above.

WELLBY SECURE SPENDING CHECKING. The Wellby Secure Spending Checking Draft account requires a minimum deposit of $100.00 to open and has no minimum balance requirements. This account is available only to members who are 18 years or older. *High Yield Requirements for this account include: You MUST have a minimum of 30 debit card Point–of–Sale (POS) transactions or 30 credit card POS transactions, or a combination of 30 debit and credit card POS transactions monthly. [A transaction is considered a Point-of-Sale (POS) transaction when you use your debit or credit card online, or physically at a POS register via tap, swipe, or insert]. Card transactions must be at least $1.00 to count toward the minimum. Debit card transactions must post (settle) in the monthly statement cycle for which they are to be counted. If requirements are met, your account will earn the stated Annual Percentage Yield (APY) as referenced in the comparison chart above. If account requirements are not met during any month, your Wellby Secure Spending Checking account will earn the lowest stated APY. In the month your account is closed, the lowest stated APY will be earned for the entire month. Rates are variable and are subject to change after the account is opened. Benefits include a choice of paper or electronic statements, and up to $15.00 in ATM withdrawal fees refunded monthly. ATM fee refunds will be paid on the last calendar day of each month. This account is eligible for Overdraft Protection, Overdraft Steward, and Overdraft Steward with Debit Card plans. There is no monthly service charge for this account.

WELLBY EARLY START CARD. Must be 4 to 12 years of age. A parent or legal guardian must open the account and authorize collection, use, and disclosure of child's information. Please refer to the COPPA Privacy and Direct Notice to Parents disclosures to understand and exercise your rights for this account. Some features may not be available from certain vendors if they don't allow anyone under the age of 13 due to Children's Online Privacy Protection Act (COPPA). The Early Start Card account requires $10.00 to open, has no minimum balance requirements, and includes a choice of paper or electronic statements. This account is a digital account with no checks provided and is exempt from NSF, Overdraft, and ATM fees. At age 13, this account will convert to a Wellby Achievement Card Account. Your Card Account and associated account number cannot be used to make payments through preauthorized direct debits from merchants, utility, or Internet service providers. If presented for payment, these preauthorized direct debits will be declined, and your payment to the merchant or provider will not be processed. The bank routing number and direct deposit account number are for the purpose of initiating direct deposits to your Card Account only. You are not authorized to provide this bank routing number and direct deposit account number to anyone other than your employer or payer. This account is eligible for the Overdraft Protection plan. Please see the Overdraft Services Disclosure for more information.

The dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply if your balance is $0.01 or above.

SUNSET ACCOUNTS:

†WELLBY SPENDING CHECKING. The Wellby Spending Checking Draft account requires $25.00 to open, has no minimum balance requirements, and includes a choice of paper or electronic statements. This account will not be assessed NSF, Overdraft, or ATM Fees. This is a digital account without the option for checks. This account is not eligible for Overdraft Steward or Overdraft Steward with Debit Card Coverage but may qualify for Overdraft Protection plans. Please see the Overdraft Services Disclosure for more information. The Wellby Spending Checking account has been sunset.

As of 12/01/2023, existing accounts will be grandfathered.

††WELLBY SPENDING PLUS CHECKING. The Wellby Spending Plus Checking Draft account requires $25.00 to open and has no minimum balance requirements. Benefits include a choice of paper or electronic statements, and up to $15.00 in ATM withdrawal fees refunded monthly. ATM fee refunds will be paid on the last calendar day of each month. This account is eligible for Overdraft Protection, Overdraft Steward, and Overdraft Steward with Debit Card plans. There is no monthly service charge for this account. This account is a tiered rate account, and the dividend rate and annual percentage yield listed for this account and tiers will be listed in the Rate Schedule. The minimum balance to obtain the stated annual percentage yield is $0.01 or above. The Wellby Spending Plus Checking account has been sunset.

As of 12/01/2023, existing accounts will be grandfathered.

WELLBY ACHIEVEMENT CARD. Must be 13 to 17 years of age. The Achievement Card account requires $10.00 to open, has no minimum balance requirements, and includes a choice of paper or electronic statements. This account is a digital account with no checks provided and is exempt from NSF, Overdraft, and ATM fees. At age 18, the account will convert to a Wellby Secure Spending Checking account. Your Card Account and associated account number cannot be used to make payments through preauthorized direct debits from merchants, utility, or Internet service providers. If presented for payment, these preauthorized direct debits will be declined, and your payment to the merchant or provider will not be processed. The bank routing number and direct deposit account number are for the purpose of initiating direct deposits to your Card Account only. You are not authorized to provide this bank routing number and direct deposit account number to anyone other than your employer or payer.

This account is eligible for the Overdraft Protection plan.

Please see the Overdraft Services Disclosure for more information. The dividend rate and annual percentage yield listed for this account in the Rate Schedule will apply if your balance is $0.01 or above.

WELLBY CERTIFICATE AND IRA TRADITIONAL, ROTH, AND EDUCATIONAL SHARE CERTIFICATES. Wellby Certificates and Traditional, Wellby Roth, and Wellby Educational IRA Share Certificate accounts require $1000.00 to open. The available terms are 6, 12, 18, 24, 36, and 48* months.

*12-Month and 48-Month Bump Up Certificate: You will receive the standard APY rate unless you qualify for the Bump Up rate. To qualify for the Bump Up rate, you must have an active checking account and have direct deposits of at least $300.00 per month; registering for and accessing online banking or mobile banking at least once every three (3) months, and one of the following: eight (8) or more point of sale (POS) debit card transactions or posted debit card payments of a bill from your Wellby checking account per month; eight (8) or more posted credit card transactions from your Wellby credit card account per month; or $40,000 or more in lending balances (does not include credit cards). If you do not meet these criteria initially, you have 90 days, from the date of account opening, to achieve these criteria. During the first 90 days, a month-end review will be completed, and if you qualify the Bump Up rate will be applied to your certificate on the first day of the month following the month in which you qualify. The 12-month certificate at maturity will auto-renew into a 12-month certificate term and rate or the term and rate selected prior to renewal or during the grace period. The 48-month certificate at maturity will auto-renew into a 48-month certificate term and rate or the term and rate selected prior to renewal or during the grace period.

Compounding and Crediting: If you close your Wellby Primary Savings account before dividends are credited, you will also be required to close your Share Certificate accounts with us, and you will receive any accrued dividends on any of the closed accounts.

Withdrawal of Dividends Prior to Maturity: The annual percentage yield assumes that dividends will remain in the account until maturity. A withdrawal of dividends prior to maturity will reduce earnings

and lower the annual percentage yield. Time Requirements: Your account will mature as specified on your Certificate or renewal notice.

BALANCE INFORMATION. Some accounts may have additional minimum opening deposit requirements. The minimum balance requirements to open and obtain the stated annual percentage yield applicable

to each account are set forth in the Wellby Truth-In-Savings Account Matrix.

If the minimum balance requirement to earn the annual percentage yield is not met, you will not earn the stated rates in the Wellby Dividend Rate Schedule. For accounts using the daily balance method as stated in the Rate Schedule, dividends are calculated by applying a periodic rate to the daily balance in the account for the dividend period. The daily rate is 1/365 of the dividend rate or in a leap year, we may use 1/366 of the interest rate.

ACCOUNT LIMITATIONS. For all new accounts, during the first 30 days, the account holders will not be permitted to use a Shared Branch to deposit or withdraw funds.

RATES. The rates provided in or with the Wellby Rate Schedule are accurate as of the effective date indicated on the Wellby website. If you have any questions or require current rate information on your accounts, please call the credit union.

FEES. See the separate Wellby Schedule of Fees and Charges for a listing of fees and charges applicable to your account(s). You authorize Wellby to charge any account in which you have an ownership interest for any such fees or charges assessed without notice to you.