February 6, 2025 | by Brian Truong

Understanding Your Credit Score and Credit Report

September 23, 2022

By The Team at Wellby

There comes a time in every young adult’s life when you should be focused on building three things: your resume, your savings, and your credit score. Each goal shapes how you make decisions today and the opportunities available to you in the future. If you’re reading this right now, you are already in the process of tackling that third primary goal: understanding and building your credit score.

There comes a time in every young adult’s life when you should be focused on building three things: your resume, your savings, and your credit score. Each goal shapes how you make decisions today and the opportunities available to you in the future. If you’re reading this right now, you are already in the process of tackling that third primary goal: understanding and building your credit score.

To do that, you will need to know what a credit score is, how it’s calculated, and how to read your credit report. Once you have mastered the basics of your credit score, you can begin intentionally raising your score to unlock future opportunities.

In this article, our goal is to help you become confident when it comes to understanding and monitoring your credit score and how your credit score factors into significant financial situations such as home loan interest rates, car loans, and career options. With this knowledge, you’ll be better prepared to make the right decisions for yourself and your financial well-being throughout the future!

What is a Credit Score?

Your credit score is a numerical calculation of your creditworthiness - or how “safe” vs. “risky” it would be to lend you money. There are many factors that can affect your scores, for example, on-time loan and credit card payments and completed loans build your credit score, while late payments and delinquent accounts will lower it. However, it’s important to know that your credit score is used to judge your overall financial trustworthiness. Employers, landlords, lenders, car dealerships, and rental companies will all evaluate your credit score before deciding what to offer you - and whether to offer you favorable rates.

Your credit score is typically calculated as a FICO score - which is a scoring system introduced by the Fair Isaac Corporation or F. I. Co. The score considers five types of financial account data to determine your creditworthiness:

- Payment history

- Current level of debt

- Variety of credit types

- Length of credit history

- Recent credit accounts

FICO credit scores range from 300 (poor) to 850 (excellent), where a good credit score is above 670. However, every lender, employer, or rental provider has its own risk threshold they will consider when it comes to credit scores.

What is a Credit Report?

A credit report is a statement of information regarding your current credit score. The credit report may include details on your current debts, loans, lines of credit, and delinquent accounts. It will likely list your recent credit history, the average age of your credit accounts, and the types of accounts you currently have.

A credit report is a statement of information regarding your current credit score. The credit report may include details on your current debts, loans, lines of credit, and delinquent accounts. It will likely list your recent credit history, the average age of your credit accounts, and the types of accounts you currently have.

You will also see identifying information like your full name, social security number, and current official address - which is not used to calculate credit scores but may be used to correct any errors in reporting.

When applying for lines of credit, loans, or when someone/an organization must conduct a "credit check," these reports will be used to determine eligibility.

How are Credit Reports Created?

Credit scores are compiled by credit bureaus through a combination of records tracking and credit reporting. Three credit bureaus release official credit scores:

Each of the scores is slightly different due to a difference in the calculation, so it's important to track all three. You can get a free credit report from each bureau every 12 months, along with other opportunities for a free credit report if - for example - you are actively jobhunting or request a free copy when authorizing a credit report on yourself by another party.

Check out the Consumer Financial Protection Bureau for a quick guide on tracking your credit score and getting regular credit reports.

Who Supplies Credit Report Information?

Banks and lenders regularly report balances, on-time or delinquent payments, dates opened or closed, and credit limit changes. All of the reported information for your accounts and loans combine for your total number of accounts, average credit age, and total credit card use.

Why Are Credit Scores So Important?

Your credit score isn’t just a measure of your current and past success with money. It is also used to judge your overall trustworthiness as a person. Any situation that involves a background check and any time someone is assessing the risk of trusting you will likely involve a credit check as well. Lenders will approve or deny a loan or determine how much they will lend you and how favorable the interest rate is, but it also goes beyond that.

Employers will decide if you can be hired or trusted with money. Landlords and rental services will decide whether to rent to you based on your credit score, and insurance providers may set higher or lower rates. Even cell phone providers use credit scores as a financial tool. Because of this, your credit score will have a more significant impact on your life than you may have originally thought.

Monitoring Your Credit Score and Credit Report

You have a right to one free copy of your credit report from each of the three major credit bureaus every year - or every 12 months. You need to see all three because you never know which will be asked for by any particular lender, renter, or employer. Each not only uses a slightly different weighting system, but they may also have different information - and not all of it accurate or even about you.

You have a right to one free copy of your credit report from each of the three major credit bureaus every year - or every 12 months. You need to see all three because you never know which will be asked for by any particular lender, renter, or employer. Each not only uses a slightly different weighting system, but they may also have different information - and not all of it accurate or even about you.

Improvement and Accuracy

There are two very important reasons to monitor your credit scores and reports. The first is to make improvements and build your credit score effectively over time. The second is accuracy. Creditors don't always report when your debts are paid, and you might even see reports for someone else's credit activity - often with a similar name to yours. Monitoring your credit score and credit report allows you to correct these inaccuracies.

When to Check Your Credit Report

Generally, it's recommended to check your credit reports once per year to know where your score is currently and to look for incorrect information that needs updating or see if you've been the victim of identity theft. However, you can also request a free copy any time someone else runs a background check on you, if you suspect recent fraud, if someone claims adverse action against you, or when you are about to apply for a job.

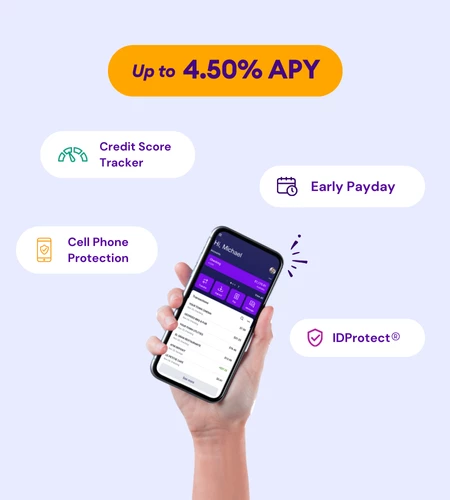

To help you keep track of your credit scores, there are a number of mobile apps you can download and use while on the go. These apps include Credit Karma, Credit Sesame, and WalletHub just to name a few.

Setting an Excellent Credit Score Goal

If you are thinking about your credit score right now - and reading this, you surely are - you know that the smart approach is to aim for an excellent credit score at all times. By regularly improving your credit score and keeping your credit reports accurate, you can improve your financial, professional, and personal opportunities over time with an ever-higher score.

Over the next few weeks, we'll cover additional topics focusing on your credit score so you can improve and maintain a high score, while also gaining a deeper understanding of how your score will affect your financial well-being. Be sure to check back with our blog to follow our credit score series!

The Team at Wellby is a diverse group that is here to help you find the right financial solutions for your unique goals and budget. Our passion is people: our members, team members, and the communities we serve. We help people find solutions that support their financial well-being, allowing them to dream and prosper.