February 6, 2025 | by Brian Truong

Successful Investment Portfolios for Young Professionals

June 12, 2024

By Brian Truong

Investment is a practical, long-term financial strategy. Good investment practices can grow your money over time in a reliable manner.

Investment is a practical, long-term financial strategy. Good investment practices can grow your money over time in a reliable manner.

Crafting a tailored investment portfolio is a crucial step towards financial stability for young professionals. This guide delves into various portfolio types, empowering young adults to select the right mix of investments to achieve their financial goals and navigate market fluctuations effectively.

Defining Investment Objectives

The first step to investment is to define your goals. Investment objectives can help you build the right portfolio or choose the right fund to achieve your purpose. Some examples include wealth accumulation, retirement planning, or reaching a specific financial milestone.

The first step to investment is to define your goals. Investment objectives can help you build the right portfolio or choose the right fund to achieve your purpose. Some examples include wealth accumulation, retirement planning, or reaching a specific financial milestone.

Once you have set your objectives, you can align your investment strategies with the right risk tolerance and time horizon.

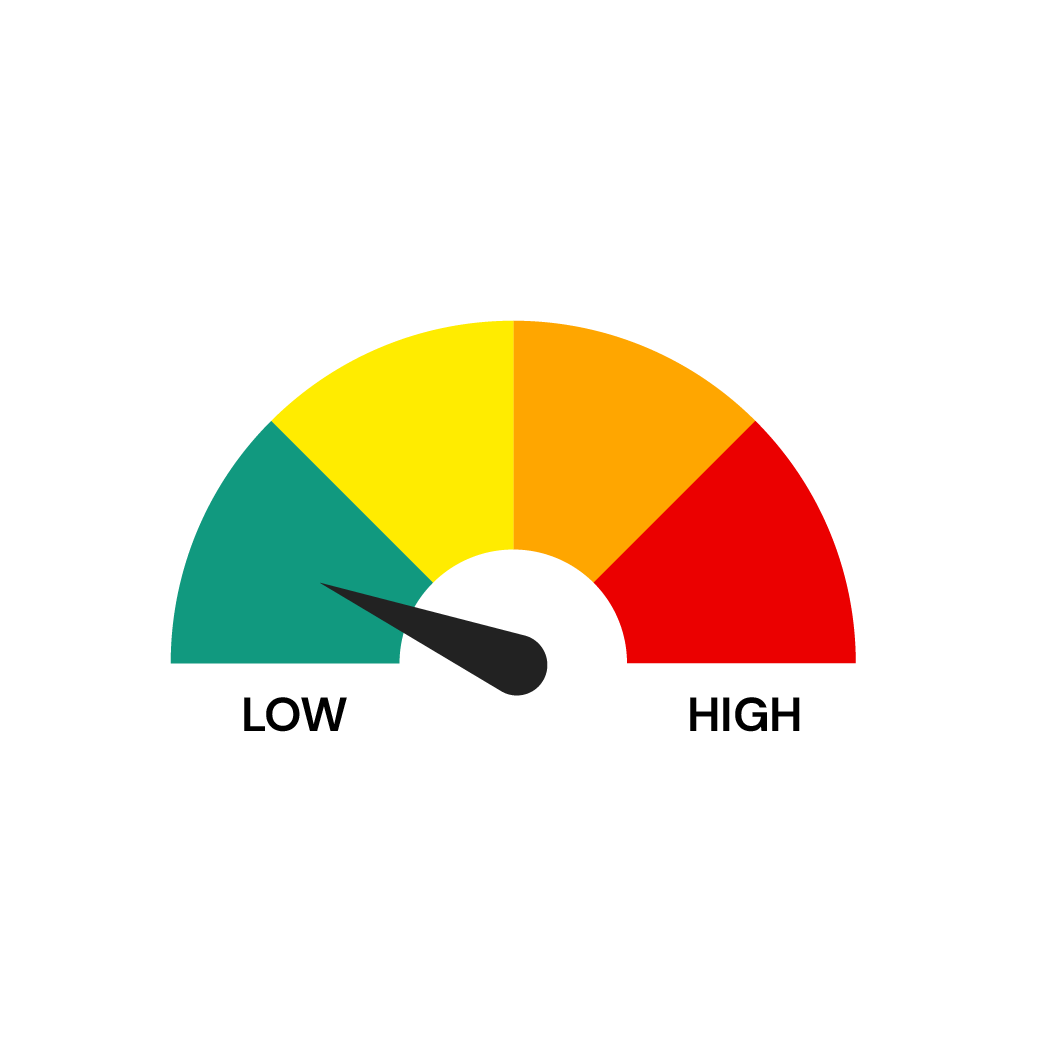

- Risk tolerance relates to the risks and rewards associated with each investment.

- Typically, higher-risk investments have a greater potential for bigger and faster financial returns - but there is also a greater chance that your money could be lost.

- A low risk tolerance means you prefer slower but more guaranteed earnings from your investments with little chance of loss.

- Time horizon indicates the time it could take to make significant gains from your investments.

- For example, investing in retirement planning is more likely to involve low-risk and distant time horizons for slow but steady gains,

- Investing to reach a financial goal may involve higher risks but more rapid financial gains.

Understanding Portfolio Types

An investment portfolio is a collection of several investments that, together, provide a risk and return profile. Portfolios can be hand-built from individual investments or you can invest in a managed fund that aligns with the portfolio you might otherwise build for yourself.

An investment portfolio is a collection of several investments that, together, provide a risk and return profile. Portfolios can be hand-built from individual investments or you can invest in a managed fund that aligns with the portfolio you might otherwise build for yourself.

There are four primary types of investment portfolios:

- Growth portfolios

- Focus on "capital appreciation" or increasing the value of your investments by investing in growing stocks that are on the rise.

- Income portfolios

- Stable and steady investments that focus on generating reliable income over time. This category includes securities and bonds with guaranteed returns or dividends.

- Balanced portfolios

- Pursues both growth and income investment strategies for both rapid and reliable returns.

- Socially responsible portfolios

- Investments that align with your social and environmental beliefs and further your ideals.

Growth Portfolios

Growth portfolios are designed to maximize capital appreciation over the long term by seeking stocks that are actively rising in value. High-growth assets include common stocks and equity mutual funds, which provide a high rate when investments are sold after growth to create a growing budget for further portfolio building.

Growth portfolios are suitable for young professionals with a long investment horizon and a higher risk for tolerance.

Income Portfolios

An income portfolio aims to generate regular income streams for investors. Gains are typically slower but also more steady than a growth portfolio. Income portfolios prioritize investments in dividend-paying stocks, bonds, and fixed-income securities. These structured investments are designed to provide investors with income without constantly buying and selling stocks at favorable prices to make gains.

Income portfolios are suitable for young professionals seeking a passive income and capital preservation based on the amount they choose to invest over time.

Balanced Portfolios

Building a balanced portfolio involves investing in a combination of growth and income assets. This provides a mix of capital appreciation opportunities and investment stability. Many financial advisors recommend a balanced portfolio, optimizing your opportunities for gains while minimizing your overall risk across your total portfolio of investments.

Balanced portfolios explore diversified investment strategies, including stocks, bonds, and alternative assets that may appreciate in value over time. A balanced investment strategy is suitable for young professionals seeking a moderate level of risk and return.

Socially Responsible Portfolios

Socially responsible portfolios have become more popular in recent years as investors become more interested in sustainable business practices and investing in companies furthering socially responsible goals. This type of portfolio focuses on integrating environmental, social, and ethical governance (ESG) criteria into investment decisions.

You may choose to invest in green organizations with a low carbon footprint. You direct your investments to support community education, minority-owned businesses, or small business growth. A socially responsible portfolio strategy suits young professionals interested in making a positive difference through their investing choices.

Consider Professional Investment Services

Working with a professional investment service allows you to rely on the insights and experience of a skilled professional advisor. Your advisor will help you determine your individual preferences, beliefs, risk appetite, and financial goals, then build you a portfolio to meet those need.

Working with a professional investment service allows you to rely on the insights and experience of a skilled professional advisor. Your advisor will help you determine your individual preferences, beliefs, risk appetite, and financial goals, then build you a portfolio to meet those need.

A professional investment service can:

- Provide you with stable investments, long-term income, or well-selected risks if you would like to try for higher returns.

- Guide you through asset allocation, investment diversification, and ongoing portfolio management, optimizing your investment performance to achieve those financial objectives you set out to reach.

- Help you build a portfolio from funds, stock purchases, and individualized support for favored companies as long as the total portfolio aligns with your investment goals.

You will also gain the opportunity to learn more about investment by discussing the strategies advised and chosen by your financial advisor.

Discover the Potential of Individual Investment Strategy

Every individual person can become an investor. Whether you invest a few dollars a month or a few thousand a year, passive income and capital appreciation can happen over time with a long-term plan. The long-term results will manifest all the sooner when you start investing now and watch your investment grow over time.

Every individual person can become an investor. Whether you invest a few dollars a month or a few thousand a year, passive income and capital appreciation can happen over time with a long-term plan. The long-term results will manifest all the sooner when you start investing now and watch your investment grow over time.

Invest in your own financial future and the socially responsible future you want to create. Continually reassess and adjust your investments to navigate changing market conditions and achieve long-term financial success.

Related Topics

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong