February 6, 2025 | by Brian Truong

Wellby Savings Accounts: Online Banking Features Made Easy

January 24, 2023

By Brian Truong

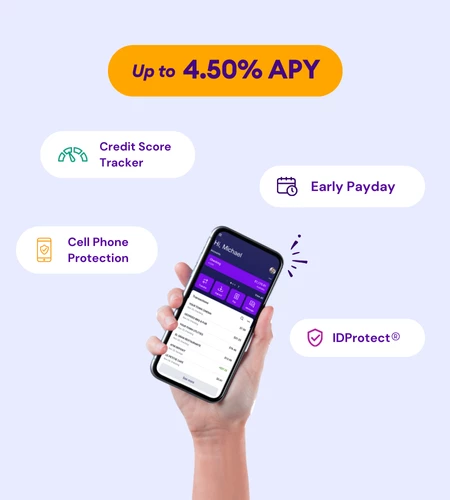

When you open an online bank account, you need a financial partner that is on your side with features that benefit your financial well-being every step of the way. At Wellby, that is exactly what we strive to provide. Every feature of your Wellby savings account is designed to help you build a financial future. We focus on making life easier and more affordable without all the old pitfalls of just-the-numbers banking institutions of the past.

Several helpful banking features are available for those who have opened a Wellby savings account. We've designed our tools to help manage and improve your day-to-day finances - and help you reach your long-term financial goals. Let's outline these features and spotlight how (and why) to best use each one for your financial journey.

Setting Up Direct Deposit

Direct deposit is a great feature available to anyone who has opened a savings account. With direct deposit, you can eliminate the delay between getting paid and having those funds available in your account. And you can do this with direct electronic transfers. With Wellby online accounts, you can have your direct deposit send funds to one or multiple savings accounts.

Direct deposit is a great feature available to anyone who has opened a savings account. With direct deposit, you can eliminate the delay between getting paid and having those funds available in your account. And you can do this with direct electronic transfers. With Wellby online accounts, you can have your direct deposit send funds to one or multiple savings accounts.

This allows you to set aside your determined amount to save every month without the risk of forgetting or accidentally spending your savings buffer. The smartest way to save is to take your savings amount off the top of your paycheck before you can start spending. This ensures you save automatically for your house-buying or nest-egg-building fund every month.

You can connect your payroll accounts to Wellby within minutes by logging into your Wellby Mobile App or our online banking platform and following a few quick steps. By setting up your direct deposit online, you can save time by skipping the typical paperwork and receiving instant confirmation that your direct deposits will start immediately.

Mobile & Online Check Deposits

Even in the age of digital banking, many employers, clients, and business contacts still pay with paper checks. Many people take a paper check to the bank monthly to deposit it with a teller or at the nearest ATM. But with Wellby, you can easily cut this routine out of your life and promptly access your funds quicker with online and mobile check deposits.

Even in the age of digital banking, many employers, clients, and business contacts still pay with paper checks. Many people take a paper check to the bank monthly to deposit it with a teller or at the nearest ATM. But with Wellby, you can easily cut this routine out of your life and promptly access your funds quicker with online and mobile check deposits.

Taking your check to the bank after being paid is another hassle we can help you avoid with a Wellby savings account. Wellby's online banking features make it possible to deposit a check online or even through your mobile phone. This way, you don't have to wait to see your payment in your online balance.

Deposit your checks on the go and enable quicker access to your funds with online and mobile check deposits. Whether you have just been paid by check for local trade, you occasionally receive checks from clients, or your employer routinely provides a paper check instead of direct deposit, Wellby has you covered and is here to make it easier to manage your daily finances with less hassle.

Our helpful tutorial video will walk you through mobile and online check deposits so you can access your checks quicker and on time every time.

Online Bill Pay

Wellby also makes it easy to pay all your bills online and automate your most important bills through our online bill pay feature. Never risk missing rent or utility payments again by setting up automatic payments. Wellby's friction-free online bill payment makes it easy to enroll in routine online payments and monitor your finances while automated payments are active. You can also manually pay your bills online for those you prefer to review before clearing the payment.

Wellby also makes it easy to pay all your bills online and automate your most important bills through our online bill pay feature. Never risk missing rent or utility payments again by setting up automatic payments. Wellby's friction-free online bill payment makes it easy to enroll in routine online payments and monitor your finances while automated payments are active. You can also manually pay your bills online for those you prefer to review before clearing the payment.

We seek to alleviate much of the stress of managing your monthly bills. Online bill pay can reduce the time it takes to manage your household finances and reduce the stress of remembering to pay your bills at the right moment. This can give you more time and energy to focus on your long-term financial goals.

Enrolling in online bill payment can be done directly online and only takes a few moments. You can also adapt your automatic bill pay settings at any time, depending on how your costs and circumstances evolve over time.

Person-to-person Payments

Wellby can also help make person-to-person payments safer, easier, and more transparent. We know that local trades, services, and purchases often occur between individuals instead of businesses, and we know that paying in cash or check can be risky. Wellby's online payment features can help you send money safely and securely from person to person online and through the Wellby Mobile App.

Wellby can also help make person-to-person payments safer, easier, and more transparent. We know that local trades, services, and purchases often occur between individuals instead of businesses, and we know that paying in cash or check can be risky. Wellby's online payment features can help you send money safely and securely from person to person online and through the Wellby Mobile App.

By adding a payee directly to the app or online, you can send secure payments to anyone for just about anything like neighborhood services (babysitting, yard work, and so on), small vendor purchases, and day-to-day expenses like splitting the lunch check with a friend.

Person-to-person payments are a fast and secure way to cover life's little expenses, creating transparent transaction records and eliminating the need to carry cash or personal checks.

Utilize Your Savings Account to Its Full Potential

Few financial institutions encourage you to explore every feature of your account and utilize it to its full potential, but that's what we're all about here at Wellby. We have assembled a suite of online banking features designed to increase your financial control, empower your financial goals, and reduce the daily stress of managing household finances.

Few financial institutions encourage you to explore every feature of your account and utilize it to its full potential, but that's what we're all about here at Wellby. We have assembled a suite of online banking features designed to increase your financial control, empower your financial goals, and reduce the daily stress of managing household finances.

Let us help you automate your savings and bills. Explore the tools available to receive and send payments on the go, and dive into your personal banking portal to discover the full scope of what every Wellby Financial account offers.

Make full use of the online banking tools available to you and take charge of your personal finances like never before. Whether you're looking to fuel your long-term savings goals, make your day-to-day banking easier, or all of the above, Wellby is here to help you achieve your full financial potential.

Related Topics

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

December 23, 2024 | by The Team at Wellby

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by The Team at Wellby