February 6, 2025 | by Brian Truong

How to Grow and Protect Your Emergency Fund

April 8, 2024

By Brian Truong

Understanding the Importance of an Emergency Fund

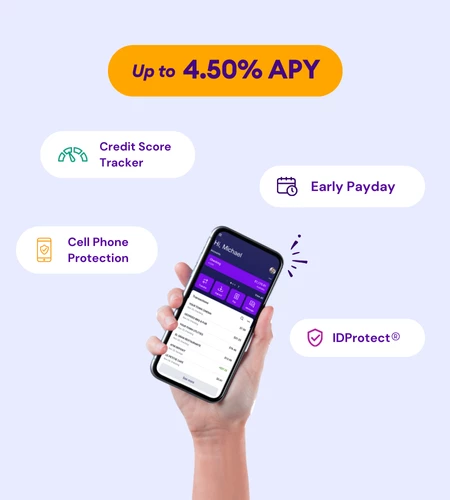

Establishing an emergency fund is fundamental to financial wellness. Building it in a high-yield savings account provides essential benefits, including:

Establishing an emergency fund is fundamental to financial wellness. Building it in a high-yield savings account provides essential benefits, including:

- Peace of mind and the ability to make better financial decisions

- Protection from unexpected expenses and life changes

- A way to earn money and grow savings as you continue to prepare for emergencies

Since unexpected expenses can happen anytime, building an emergency fund for yourself as soon as possible is vital.

Starting an Emergency Fund

Reviewing your financial situation and setting clear goals are essential to building an emergency fund.

Reviewing your financial situation and setting clear goals are essential to building an emergency fund.

- Review your Expenses - Assess your current spending habits to clarify which expenses are vital and which you can give up in an emergency. Be realistic about how much you will likely spend on various categories of costs.

- Outline your Financial Needs - Determine how much you need to withstand turbulent life events such as job loss, unexpected medical bills, car repairs, etc.

- Create your Emergency Fund Timeline - Evaluate how much you can save monthly to estimate the time it will take to establish your emergency fund.

Setting a goal of when you want to establish an emergency fund can help keep you on track and guide your spending habits.

Growing Your Emergency Fund Strategically

After establishing your emergency fund, you can look at strategies to help you grow your savings and improve financial stability.

After establishing your emergency fund, you can look at strategies to help you grow your savings and improve financial stability.

- Set Up Automatic Contributions - You can put everything on autopilot and allow your emergency savings to build up automatically. After establishing an amount to withdraw each period, you don’t have to think about these contributions again. Psychology suggests that most of us are more likely to make the right financial choices when the actions are pre-planned and automated.

- Deploy Safe Investment Strategies - You want to ensure your investments are manageable and low-risk while still providing a return on your money.

Protecting Your Emergency Fund

After working as hard as you do to create your emergency fund, you must take steps to protect and maintain it. Work to anticipate and avoid risks such as:

After working as hard as you do to create your emergency fund, you must take steps to protect and maintain it. Work to anticipate and avoid risks such as:

- Overspending - Remember, your emergency fund is in place to give yourself a cushion against unexpected expenses. Consider keeping it in a separate account that is more challenging for you to access.

- Unexpected bills - Consider insurance options for your health and high-ticket items such as your car and home. Insurance will help you avoid hefty charges you can’t afford at the cost of monthly premiums.

- Identity theft - Choose a savings account that provides identity theft recovery benefits to avoid becoming a victim of fraudulent incidents.

Maximizing Savings Opportunities

You can make an immediate impact on your financial situation by saving where you can. Common ways to save and progress toward financial stability:

You can make an immediate impact on your financial situation by saving where you can. Common ways to save and progress toward financial stability:

- Reduce Expenses - Create a detailed budget outlining your income and expenses. Track your spending regularly and identify areas where you can cut back.

- Cancel Subscriptions - Review your monthly subscriptions and cancel any that you don’t use or need. This includes streaming services, gym memberships, and magazine subscriptions.

- Consider a Health Savings account (HSA) - if eligible, contribute to an HSA to prepare for medical expenses. These accounts offer tax benefits on qualified medical costs.

- Lower Debt - Prioritize paying off high-interest debt to save on interest charges.

Reassessing and Adjusting Your Financial Plan

Remember that you can and should review your financial plan regularly. Life changes constantly, and your budget should be as dynamic as yours. Set aside time each month to assess your financial situation and goals.

Remember that you can and should review your financial plan regularly. Life changes constantly, and your budget should be as dynamic as yours. Set aside time each month to assess your financial situation and goals.

The bottom line? Establishing an emergency fund is a proactive way to build financial stability. Consider savings accounts and other low-risk options to grow your nest egg.

Related Topics

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong