February 6, 2025 | by Brian Truong

Four Most Common Savings Accounts: Which One is Right For You?

January 13, 2023

By Chad Carpenter

Are you looking for a savings account but don't know which one to choose? We'll discuss the four most common types of savings accounts to help you decide what works best for you. We'll look at traditional savings accounts, high-yield accounts, certificates of deposit (CDs), and specialty accounts. With this information, you can make a more informed decision about your financial future when trying to decide how to choose the right savings account for you.

Are you looking for a savings account but don't know which one to choose? We'll discuss the four most common types of savings accounts to help you decide what works best for you. We'll look at traditional savings accounts, high-yield accounts, certificates of deposit (CDs), and specialty accounts. With this information, you can make a more informed decision about your financial future when trying to decide how to choose the right savings account for you.

Traditional Savings Account

Traditional savings accounts are the most common accounts people open when they want to start putting money aside for their next financial goal, build an emergency fund, or start growing their savings with earned interest.

People often choose to open a traditional savings account because of its simplicity and low risk. With this type of account, it's easy to make regular deposits into your savings, as there are usually no minimum balance or monthly fees associated with them. This makes it an ideal choice for people who want to save a little each month to build up their emergency fund or even plan ahead for major purchases. Additionally, the interest rates on these accounts tend to be higher than those on checking accounts, meaning you can earn more money each year just by having your funds deposited in the right place.

People often choose to open a traditional savings account because of its simplicity and low risk. With this type of account, it's easy to make regular deposits into your savings, as there are usually no minimum balance or monthly fees associated with them. This makes it an ideal choice for people who want to save a little each month to build up their emergency fund or even plan ahead for major purchases. Additionally, the interest rates on these accounts tend to be higher than those on checking accounts, meaning you can earn more money each year just by having your funds deposited in the right place.

Traditional savings accounts are also great tools if you're trying to save consistently throughout the year. They offer accessibility that other forms of saving don't provide. For example, you can set up automatic transfers from your checking account, which gives you the option to automatically deposit part of your paychecks into savings to help build toward your savings goals. This helps ensure that you have a steady stream of income going toward building your nest egg without any extra effort.

Here at Wellby, we offer a Wellby Savings Account with a $0 initial deposit and $0 monthly service fees, allowing you to start your savings journey quickly and easily.

High-yield Savings Account

High-yield savings accounts are less well-known than basic savings accounts.

High-yield savings accounts are less well-known than basic savings accounts.

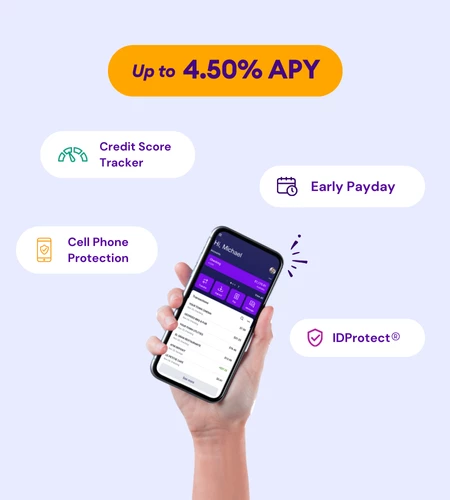

For those looking to save for a longer period of time, high-yield savings accounts might be the way to go. Opposed to traditional savings accounts, these offer higher interest rates, meaning more money in your pocket over time.

However it's important to remember that high-yield savings accounts are better for long-term use because they typically have withdrawal restrictions limiting how many times you can withdraw from an ATM. So, if you're using your savings account on a regular basis, this type of account might not be the best option for you.

High-yield savings accounts are also great if you're looking to invest and make the most out of compound interest. Unlike other types of investing which require knowledge and research on stocks and bonds, this type of account is relatively easy. Just deposit money regularly and it will start growing automatically.

Unfortunately, some financial institutions charge fees or require minimum balances when opening high-yield savings accounts which might seem like a burden. Well, we're here for you. You can open a Wellby Savings Plus account with only $25. After opening, there is no minimum balance and the account comes with $0 monthly service fees.

Certificate of Deposit (CD)

CD accounts are unique. You're essentially depositing your money with the plan to not withdraw it for the term of the CD. In exchange, you'll receive a higher interest rate than traditional or high-yield accounts. While initial deposits for this type of account are higher, the amount you can earn on your invested funds is also typically higher.

When it comes to CD accounts, the length of your term is an important factor. A long-term CD will usually have a higher interest rate than a short-term one, as you're essentially committing more money for a longer period of time. This means if you want to make bigger returns on your investments and are willing to wait out the entire tenure before withdrawing any funds, then going with a long-term CD might be the way to go. The main drawback here is that most CDs come with penalties if you withdraw funds before maturity, so it's important to weigh the pros and cons carefully before making any decisions.

When it comes to CD accounts, the length of your term is an important factor. A long-term CD will usually have a higher interest rate than a short-term one, as you're essentially committing more money for a longer period of time. This means if you want to make bigger returns on your investments and are willing to wait out the entire tenure before withdrawing any funds, then going with a long-term CD might be the way to go. The main drawback here is that most CDs come with penalties if you withdraw funds before maturity, so it's important to weigh the pros and cons carefully before making any decisions.

When you open a CD account, you'll have a term length between 6 and 48 months. Your term length and the amount of funds you deposit determine the amount of interest the account can earn.

These types of accounts are typically best for the money you won't immediately need, as they may encounter withdrawal penalties if they withdraw the money before the account's maturity date.

Let's work together to accomplish your financial goals. Wellby's Share Certificates offer flexibility and guaranteed rates for your set term limit. Depending on the amount you invest, you may be eligible for higher dividend rates. With an initial deposit of $500, you can begin saving for your future and growing your investment.

Specialty Savings Accounts

Looking for a savings account that serves a more specific purpose? Consider a youth savings account. Youth savings accounts are a great way to get kids started on their saving journey, while also providing you with peace of mind. The interest rates on these accounts tend to be higher than those found in traditional savings, making it easier for young savers to build up their funds more quickly.

Looking for a savings account that serves a more specific purpose? Consider a youth savings account. Youth savings accounts are a great way to get kids started on their saving journey, while also providing you with peace of mind. The interest rates on these accounts tend to be higher than those found in traditional savings, making it easier for young savers to build up their funds more quickly.

Plus, incentives such as no minimum account balances or waived fees for children under 18, can help make the process even simpler. Additionally, youth accounts often come with educational tools and features designed specifically for helping teach financial literacy — something that will definitely benefit them into adulthood. Open a Youth Savings account with us with just a $5 initial deposit, no minimum balance after opening, and a $0 monthly service fee.

IRA accounts are another great option for rounding out your savings goals. They provide tax-deferred growth on investments like stocks and bonds and can offer much higher returns compared to other types of retirement plans or investment vehicles over time. That said, there are contribution limits associated with IRAs, so you'll want to make sure you're aware of these before setting one up. But overall, they can be an excellent way to diversify your portfolio and ensure you have enough money set aside for later. Planning for retirement? Consider Wellby's IRA Account. Set savings goals big or small, and benefit from a $0 initial deposit.

You deserve to accomplish your goals. We're here to help you along the way with a youth savings account or IRA account -- whatever suits your needs.

Start Your Savings Journey Today!

It's never too early to start saving for your future. Whether you want to be able to retire comfortably, visit faraway places, or just save up for a rainy day fund, having an understanding of different types of savings accounts and how they can help you reach your goals is the first step on your journey.

It's never too early to start saving for your future. Whether you want to be able to retire comfortably, visit faraway places, or just save up for a rainy day fund, having an understanding of different types of savings accounts and how they can help you reach your goals is the first step on your journey.

No matter what kind of financial goals you have in mind, there's sure to be a type of savings account out there to suit you, from traditional and high-yield accounts to specialty accounts specifically tailored to youth or retirement savers. Start your financial journey today by doing your research, finding the best account for your needs, and committing yourself to gradually growing better financial habits that help you save more money along the way. Wellby Financial is always here for you to support you by removing the barriers on your financial journey.

Related Topics

Chad Carpenter hails from Dallas, Texas, and lived in Denver, Colorado, for 15 years before landing in Houston. Chad has over 20 years of marketing and SEO experience, including several years in the agency world. When he’s not clacking away on his keyboard optimizing Wellby's digital presence, digging into data, or immersed in AI, Chad enjoys good food, good friends, and good movies (just don’t expect him to watch any in interactive 4D). Chad has two cats, one that loves him and one who is aloof.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong