February 6, 2025 | by Brian Truong

10 Tips in Financial Planning to Give Young Adults a Head Start

May 14, 2024

By Brian Truong

You are a young adult at the beginning of your career and earning potential With a limited credit history and likely little savings, you can jumpstart your journey to financial stability through thoughtful planning. The sooner you build the right habits, the better off your finances will be two, five, ten, and fifty years from now.

Planning well will allow you to:

- Earn more from savings

- Gain peace of mind by establishing an emergency fund

- Establish long-term wealth-building strategies

Getting an early start on your financial strategy doesn’t have to be hard. Here are ten tips every young adult should know about financial planning.

1. Start Saving Early, Even a Little Each Month

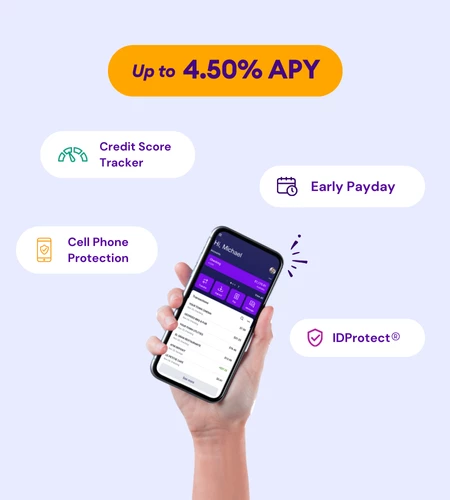

Start saving. Even if it’s your pocket change or what’s left over after your weekend pizza, begin putting aside some funds in a high-yield savings account every month.

Start saving. Even if it’s your pocket change or what’s left over after your weekend pizza, begin putting aside some funds in a high-yield savings account every month.

Start by:

- Automating your contributions each month

- Signing up for a round-up debit card

- Reviewing your previous month’s expenses

Just get started, and save a little every month that you won’t spend except for emergencies. Your future self will thank you later on when you need that money and when you’ve established a saving habit that keeps your emergency fund/nest egg topped up.

2. Open a Few Long-Term Accounts

One of the most powerful aspects of your credit report is the age of your accounts. This includes bank accounts and credit cards, so open a few accounts you plan to keep. The longer these accounts are open, the better "standing" your financial history will have as an established person of finances.

One of the most powerful aspects of your credit report is the age of your accounts. This includes bank accounts and credit cards, so open a few accounts you plan to keep. The longer these accounts are open, the better "standing" your financial history will have as an established person of finances.

A few accounts to consider opening:

- A free checking account

- A savings account

- An everyday (groceries and gas) credit card that you will instantly pay off

- An emergency/travel credit card for special occasions.

3. Get in the Habit of Checking Your Transaction History

Add your bank transaction page to the list of items you browse regularly, such as emails, social media, and news feeds. This will allow you to skim recent purchases and reflect on your spending habits.

Add your bank transaction page to the list of items you browse regularly, such as emails, social media, and news feeds. This will allow you to skim recent purchases and reflect on your spending habits.

95% of the time, you’re only thought will be, "Yup, I bought that." 4.9% of the time, you’ll think, "I didn’t need to spend on that," and discover a chance to save. You may also find unexpected charges to review for possible fraud and identity theft.

4. Enroll in Employer Retirement Programs & Contribute

Sign up for the retirement program at your current job. Employers not only offer an account and a chance to make (tax-free!) contributions to your future retirement; many of them offer "matching", meaning they’ll double what you contribute

Sign up for the retirement program at your current job. Employers not only offer an account and a chance to make (tax-free!) contributions to your future retirement; many of them offer "matching", meaning they’ll double what you contribute

Not only that, but these accounts follow you, and you can wrap them up into a massive final 401(k) or IRA, no matter how many jobs you float through in the next 40 years of your career.

5. Invest in Quality Clothes and Equipment

Things that are built to last and that you know you will use many times can save you money in the long run on years of replacements and half-measures. Just do your research, so you know you are investing in long-term quality.

Things that are built to last and that you know you will use many times can save you money in the long run on years of replacements and half-measures. Just do your research, so you know you are investing in long-term quality.

You may consider investing in:

- A good wardrobe for both home and work

- High-quality hand tools

- Reusable vs. disposable options

You can research prices and reviews online to make an informed purchase once you decide what’s needed.

6. Learn to Cook a Few Good Meals

Another smart way to save over the next few decades is cooking at home. You don’t have to be a master chef, just have 3-5 simple meals you can make with low-cost ingredients. Have at least one zero-effort recipe for when you need food, and your brain won’t engage. Have another for date night wow factor and at least one childhood comfort food.

Another smart way to save over the next few decades is cooking at home. You don’t have to be a master chef, just have 3-5 simple meals you can make with low-cost ingredients. Have at least one zero-effort recipe for when you need food, and your brain won’t engage. Have another for date night wow factor and at least one childhood comfort food.

7. Discover What You Love to Do at Low Costs

Consider your hobbies. Many young adults get swept up in what they’re "supposed to do" in their 20s. In truth, if you’re spending your paycheck every weekend, there are probably more affordable ways to have fun. So, find your bliss.

Consider your hobbies. Many young adults get swept up in what they’re "supposed to do" in their 20s. In truth, if you’re spending your paycheck every weekend, there are probably more affordable ways to have fun. So, find your bliss.

Discover the hobbies you love that cost almost nothing, such as:

- Going on nature walks

- Repainting upcycled furniture

- Exploring the low-cost museums and exhibits in your own city

If you discover your low-cost hobbies early in life, you can spend your entire career enjoying them and tucking away the savings.

8. Take Care of Your Health

If you don’t want to worry about health conditions and doctor visits in your 30s (and later), take care of your health in your 20s. Exercise frequently and eat well, even though you are capable of living on junk and looking great without the gym. Take care of your teeth and visit a doctor early about any little symptoms that concern you.

If you don’t want to worry about health conditions and doctor visits in your 30s (and later), take care of your health in your 20s. Exercise frequently and eat well, even though you are capable of living on junk and looking great without the gym. Take care of your teeth and visit a doctor early about any little symptoms that concern you.

The goal is to "run up the score" on your health before the more challenging next level when your metabolism and white blood cells slow down and health costs increase. It's closer than you think.

9. Get Ready for Good Debt

"Good debt" is the kind of stable, incremental debt that you take out on purpose. It is debt that significantly increases your credit score as you pay it off. Car loans, mortgages, and some lines of credit are "good debt" that will improve your finances if you choose to engage.

"Good debt" is the kind of stable, incremental debt that you take out on purpose. It is debt that significantly increases your credit score as you pay it off. Car loans, mortgages, and some lines of credit are "good debt" that will improve your finances if you choose to engage.

Most adults manage at least one debt, and often, it’s a healthy part of their financial plan. So, brace yourself. Debt is in your future, and it’s probably a net positive.

10. Request Your Annual Credit Reports

Lastly, remember to request your annual full-detail credit reports. Every year, each of the 3 major credit bureaus is required to provide every person a full view of their credit report - what employers, lenders, and rental companies see when they look you up.

Lastly, remember to request your annual full-detail credit reports. Every year, each of the 3 major credit bureaus is required to provide every person a full view of their credit report - what employers, lenders, and rental companies see when they look you up.

Seeing your credit report will give you a full view of your on-paper financial history and allow you to correct any mistakes that might be dragging down your score. Do this every year, and you'll soon have a clear insight into what makes your credit score even stronger over time.

Related Topics

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

December 23, 2024 | by Brian Truong

Budgeting 101: Comparing Fixed and Variable Costs

December 12, 2024 | by Brian Truong