February 6, 2025 | by Brian Truong

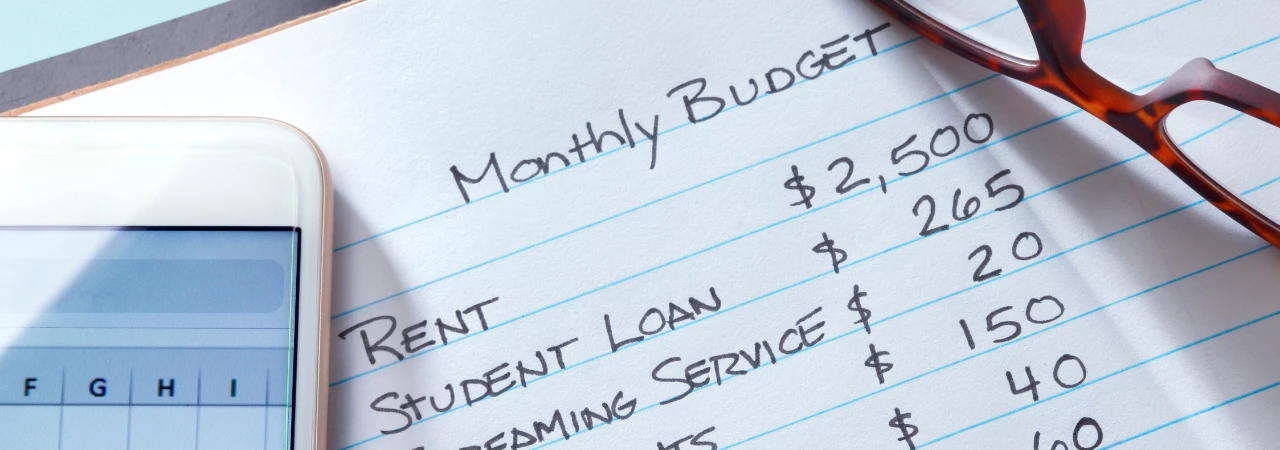

Budgeting 101: Comparing Fixed and Variable Costs

December 23, 2024

By Brian Truong

The power of budgeting is the ability to define and control how you spend. A solid budgeting strategy starts with understanding your expenses, especially the difference between fixed and variable costs.

This guide will help you break down these two types of costs to make a budget that adapts to your financial needs and goals.

What Are Fixed Expenses?

Fixed expenses are recurring, predictable costs such as rent, loan payments, and insurance. While you can change them, fixing your costs up or down may require a significant lifestyle change. They are often necessary in your daily budget and remain the same each month.

Fixed expenses are recurring, predictable costs such as rent, loan payments, and insurance. While you can change them, fixing your costs up or down may require a significant lifestyle change. They are often necessary in your daily budget and remain the same each month.

Fixed expenses are usually easier to budget because they remain consistent.

Common Examples of Fixed Expenses

- Rent or mortgage payments

- Property taxes

- Car payments

- Insurance premiums

- Stable utilities (ex: phone bill or trash service)

- Subscriptions

- Tuition or childcare

What Are Variable Expenses?

Variable expenses are costs that fluctuate and are not the same every month. Some costs change based on your activities, like groceries, while others change based on the time of year, such as the power bill.

Variable expenses are costs that fluctuate and are not the same every month. Some costs change based on your activities, like groceries, while others change based on the time of year, such as the power bill.

Variable expenses vary based on lifestyle, season, habits, and behaviors. They are less predictable than fixed costs. Most variable expenses give you some ability to control their costs by changing your behavior and are less predictable than fixed costs.

Common Examples of Variable Expenses

- Weekly groceries

- Dining out and ordering food

- Entertainment costs

- Transportation and travel

- Monthly utilities by season (ex: power bill and water bill)

- Personal shopping

- Hobby supplies

- Healthcare and medical bills

- Repairs and maintenance

- Holiday costs

Tracking your variable expenses to manage your budget is essential because many costs are controllable.

How to Balance Fixed and Variable Expenses in Your Budget

When building your budget, your fixed expenses are the natural starting place. Establishing your fixed expenses will form the structure or bones of your budget, as it defines the baseline of how much you will predictably spend on necessary and lifestyle costs. Then, you can adapt your budget based on your needs and preferences regarding variable expenses.

Define Fixed vs Variable Expenses

The first step is to define your fixed vs. variable expenses. Build your two lists and separate them.

Establish Essential Fixed and Variable Expenses

Identify which fixed expenses are necessary, such as rent, insurance, utilities, etc. Determine the total and write it down. Identify the essential variable expenses, like groceries, gas, and power bills. Estimate their average cost and write it down.

Review Fixed Expenses

Determine which fixed expenses are optional. These might include subscriptions and memberships you could cut to get back a predictable portion of your income to spend on other things.

Set Limits for Controllable Variable Expenses

Define a limit on how much you want to spend on the variable expenses. For example, you can set a budget for maximum weekly grocery spending and a monthly limit for entertainment and recreational activities.

Create a Margin for Uncontrollable Variable Expenses

For variable expenses you can't control - like the power bill - create a margin in your budget and build up a savings account for emergency overspending on things like heat waves or medical bills.

Adjusting for Seasonal or Irregular Variable Expenses

One of the most challenging aspects of budget-building is dealing with variable expenses you can't control. The power bill, for example, is seasonal but also subject to unique weather patterns. Most households pay more for AC cooling power in the summer. Fortunately, you can often use your annual power bill history to predict seasonal expenses and prepare enough room in your budget.

The holiday season brings holiday shopping, which varies in cost based on how you shop. Many people save up for several months before the holidays to make room in their budget for extra shopping.

Establishing an emergency fund can help you deal with emergencies like medical bills or house repairs. Planning for these unexpected costs can help you build financial stability.

Tips for Reducing Both Fixed and Variable Costs

You can refine and reduce your fixed and variable costs in several ways. Small changes in both categories can add significant savings to your overall budget monthly and yearly.

You can refine and reduce your fixed and variable costs in several ways. Small changes in both categories can add significant savings to your overall budget monthly and yearly.

Reducing Fixed Costs

- Cancel under-used subscriptions and memberships

- Renegotiate or refinance loans and debt payments

- Shop for more affordable plans (phone, insurance, etc)

Reducing Variable Expenses

- Plan meals and grocery lists

- Set limits for impulse spending

- Find free or low-cost activities

- Invest in energy-efficient home improvements

Mastering Your Fixed and Variable Expenses

Understanding the difference between fixed and variable expenses is essential to building a reliable budget. Monitor both types of expenses regularly and adjust as needed to advance your financial stability.

Related Topics

Brian Truong was born in Canada (cool, eh?) and grew up in Sugar Land, Texas. Brian has over 12 years of SEO and marketing experience in a wide array of industries, including finance and real estate. When he’s not flexing his SEO and web development superpowers, he enjoys video games, anime, horror movies, and spending time with his cat, Chi.

Related articles you might like

December 12, 2024 | by Brian Truong

Unpacking Mortgage Types for First-Time Buyers

November 20, 2024 | by The Team at Wellby